DỰ ÁN SUN GROUP QUANG HANH - NGHỈ DƯỠNG KHOÁNG NÓNG YOKO ONSEN VILLAS

Dự án Sun Group Quang Hanh – Lần đầu tiên du khách sẽ được trải nghiệm một không gian nghỉ dưỡng đậm chất Nhật Bản tại tỉnh Quảng Ninh. Tại đây, du khách như được ở “chốn bồng lai tiên cảnh”, dự án hứa hẹn sẽ là điểm dừng chân an cư lý tưởng, một điểm đầu tư đáng giá dành cho giới đầu tư.

Một khu đô thị biển đẳng cấp mang phong cách Nhật Bản với hệ thống suối khoáng nóng có 1.0.2 được xây dựng tại Quang Hanh dự báo sẽ là “cơn sốt” đầu tư bất động sản Quảng Ninh trong thời gian tới.

THÔNG TIN TỔNG QUAN DỰ ÁN SUNGROUP QUANG HANH TẠI CẨM PHẢ - QUẢNG NINH

Tên dự án: Sun Onsen Quang Hanh(Chưa chính thức)

- Vị trí : Phường Quang Hanh, TP. Cẩm Phả, Quảng Ninh

- Chủ đầu tư: Tập đoàn Sunngroup.

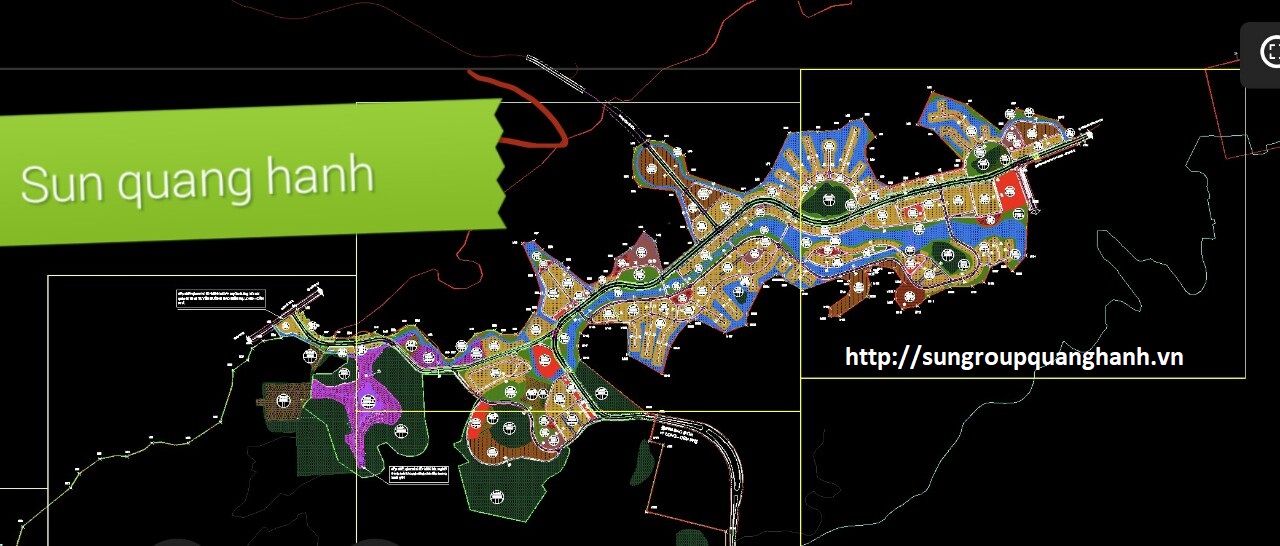

- Quy mô: hơn 1000ha

- Sản phẩm được mở bán gồm: Biệt thự nghỉ dưỡng, biệt thự song lập, biệt thự đơn lập, biệt thự liền kề và nhà phố shophouse.

- Các hạng mục đầu tư: Khu nghỉ dưỡng suối khoáng nóng Yoko Onsen Quang Hanh, Khu biệt thự nghỉ dưỡng, Khu shophouse thương mại dịch vụ.

- Thời gian khởi công: Đang thi công

- Thời gian hoàn thành: Đang cập nhật

- Thời gian bàn giao: Đang cập nhật

- Hình thức sở hữu: lâu dài

LIÊN HỆ PHÒNG TƯ VẤN BÁN HÀNG DỰ ÁN SUN ONSEN VILLA QUANG HANH

HOTLINE HỖ TRỢ XEM DỰ ÁN : 0906886882

Vui lòng gửi thông tin quan tâm về dự án của Sun Group tại Quang Hanh, tư vấn viên của chúng tôi sẽ trực tiếp gửi thông tin và chuyển đến quý khách trong thời gian sớm nhất. Chân thành cảm ơn !

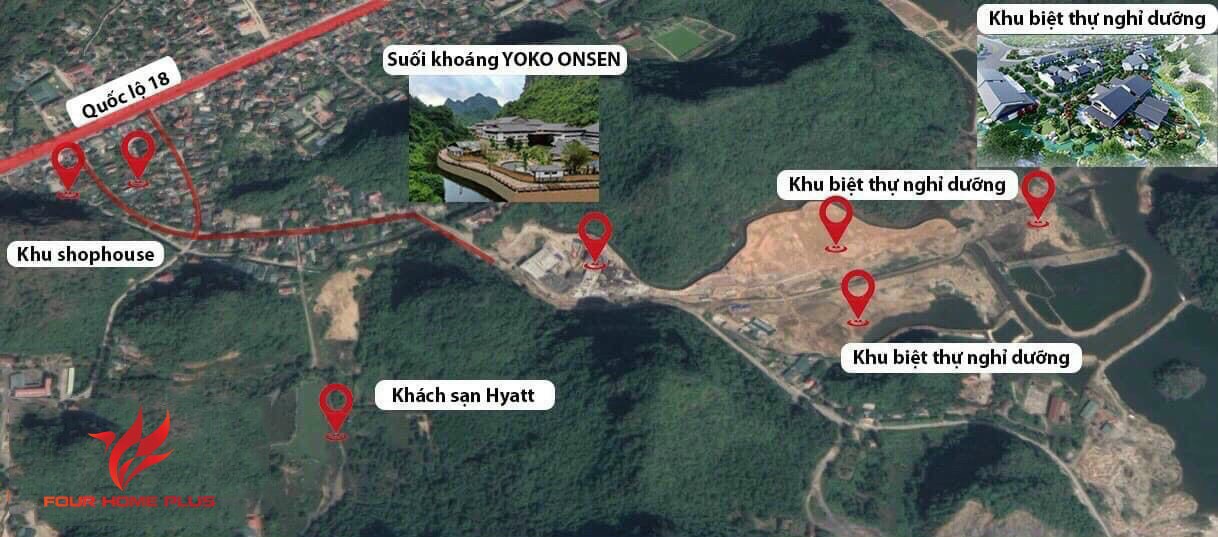

VỊ TRÍ DỰ ÁN KHU NGHỈ DƯỠNG SUN ONSEN QUANG HANH

Dự án SunGroup Quang Hanh tọa lạc tại phường Quang Hanh, thành phố Cẩm Phả.

- Khu đô thị SunGroup Quang Hanh nằm cách Hạ Long chỉ khoảng 10km và cách trung tâm Cẩm Phả 15km về phía Tây.

- Dự án SunGroup tại Quang Hanh sở hữu vị trí đắc địa nằm trong quần thể khu sinh thái nghỉ dưỡng với quy mô lên đến hơn 1000 ha, bao gồm các hạng đầu mục đầu tư Khu suối khoáng Yoko Onsen Quang Hanh, khu biệt thự nghỉ dưỡng, hệ thống cảnh quan vườn Nhật, hệ thống cây xanh, …

- Khu nghỉ dưỡng này là được bao bọc giữa các dãy núi, nơi đây thiên nhiên vẫn còn hoang sơ, không gian xung quanh yên tĩnh. Với tất cả các yếu tố thuận lợi, dự án thích hợp là một nơi dừng chân thích hợp dành cho mọi khách hàng và cư dân với hệ thống tiện ích dạ dạng.

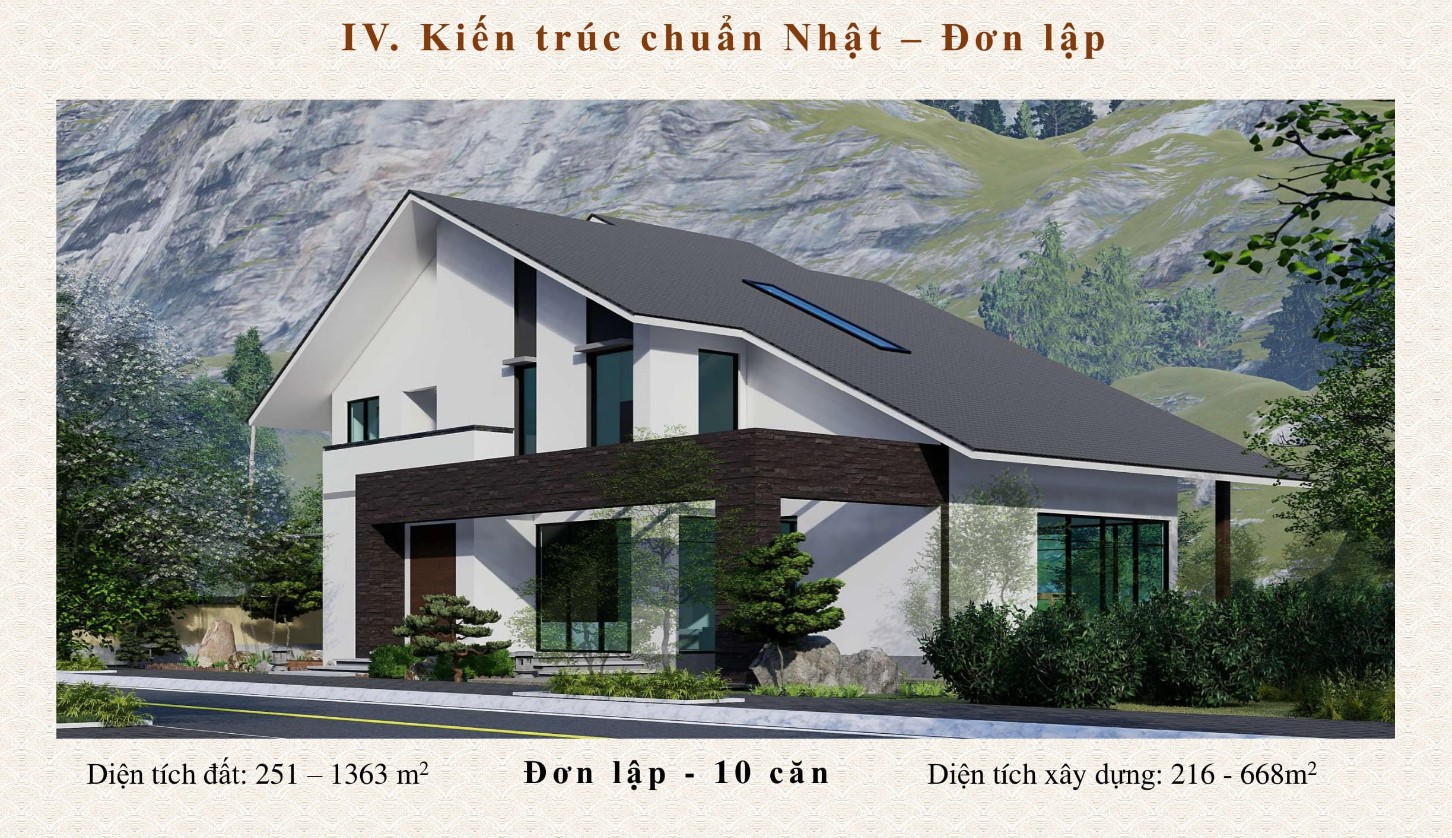

CÁC LOẠI HÌNH BẤT ĐỘNG SẢN TẠI DỰ ÁN SUN GROUP TẠI QUANG HANH

Xuất hiện tại khu nghỉ dưỡng mang phong cách Nhật Bản Yoko Onsen Quang Hanh Villa tại Quang Hanh là các loại hình bất động sản như :

- Biệt thự tứ lập

- Biệt thự song lập

- Biệt thự đơn lập

- Nhà phố thương mại shophouse

KHU NGHỈ DƯỠNG SUN GROUP ONSEN QUANG HANH SỞ HỮU HỆ THỐNG TIỆN ÍCH ĐA DẠNG

Dự án nằm tại vị trí đắc địa "Sơn Thuỷ Hữu Tình" kết hợp kiến trúc Nhật Bản đẳng cấp với nguồn suối khoáng nóng tự nhiên có 1.0.2 tạo nên hệ thống nghỉ dưỡng đặc sắc tại Quang Hanh:

- Khu shophouse tạo ra không gian mua sắm, nhà hành đa dạng để du khách có thể trải nghiệm.

- Khu suối khoáng Yoko Onsen Quang Hanh - khu nghỉ dưỡng suối khoáng nóng đầu tiên tại Việt Nam được kiến tạo và vận hành dựa trên những tiêu chuẩn khắt khe theo đúng phong cách Onsen Nhật Bản.

- Khu nghỉ dưỡng nằm giữa các dãy núi, khi nhìn từ trên cao, SunGroup Quang Hanh giống như một ngôi làng nhỏ ở Nhật Bản. Với các căn biệt thự mang phong cách kiến trúc Nhật truyền thống. Tại nơi đây, với “cảm hứng nghỉ dưỡng” bao phủ trọn vẹn mọi không gian sống; với sắc xanh tươi mát của cảnh quan nước tĩnh tại len lỏi khắp nội khu, tràn đầy năng lượng tại khu suối nóng; với tầm nhìn bao trọn đẫm ánh ngọc bích.

Hệ thống tiện ích tại SunGroup Quang Hanh được CĐT đầu tư một cách kĩ càng và chất lượng, hướng tới một khu nghỉ dưỡng sinh thái hàng đầu tại thành phố Cẩm Phả.

ĐIỂM NỔI BẬT TẠI DỰ ÁN NGHỈ DƯỠNG SUN ONSEN QUANG HANH

Độc : Khu nghỉ dưỡng sinh thái với suối khoáng nóng đẳng cấp quốc tế theo phong cách chuẩn Nhật Bản đầu tiên tại Việt Nam, đem đến cho du khách khi đến Khu nghỉ dưỡng thêm những trải nghiệm mới mẻ, độc đáo nhờ nguồn suối khoáng nóng Quang Hanh có giá trị cao với sức khỏe.

Vị trí đắc địa : Tính đắc địa chính là khả năng kết nối giao thông, liên kết vùng dễ dàng, thông suốt với trung tâm và mức độ đa dạng của hệ thống tiện ích quanh khu vực đó. Dự án SunGroup mang trong mình đầy đủ các yếu tố thuận lợi về không gian nghỉ dưỡng, an cư lâu dài cho mọi du khách.

Chủ đầu tư uy tín : Khu đô thị SunGroup Quang Hanh được đầu tư và xây dựng bởi tập đoàn SunGroup. Khi nhắc tới CĐT SunGroup không thể không nhắc tới các dự án đã rất thánh công khi được tập đoàn này triển khai và xây dựng như: Khu Premier Village Hạ Long Bay, Tháp Domino – tòa tháp cao thứ 8 thế giới, Cao tốc Hạ Long – Vân Đồn,…

Tập đoàn Sun Group xây dựng Khu đô thị SunGroup với sự kỳ vọng, với nhiều sản phẩm, hệ thống tiện ích hấp dẫn, mới mẻ, khu nghỉ dưỡng suối khoáng sẽ trở thành điểm đến mới hút khách, giúp du khách đến với tỉnh Quảng Ninh có nhiều lựa chọn hơn để trải nghiệm, để an cư tại khu đô thị đáng sống này.

Tập đoàn Sun Group ra mắt quần thể nghỉ dưỡng chuẩn Nhật Bản với hệ thống biệt thự Sun Onsen tại Quang Hanh - Cẩm Phả - Quảng Ninh. Sự kiện đặc biệt này không chỉ là điểm nhất cho bước phát triển của hệ thống nghỉ dưỡng 5* mang thương hiệu Sun Group tại khu vực miền Bắc mà còn là cơ hội đầu tư lớn cho các nhà đầu tư bất động sản tại Việt Nam. Các nhà đầu tư tương lai tại dự án Sun Onsen Quang Hanh sẽ được tận hưởng trọn bộ đặc quyềnh nghỉ đưỡng cao cấp nhất hiện nay mang phong cách hoàn toàn mới mẻ.

LIÊN HỆ PHÒNG TƯ VẤN BÁN HÀNG DỰ ÁN SUN ONSEN VILLA QUANG HANH

Vui lòng gửi thông tin quan tâm về dự án của Sun Group tại Quang Hanh, tư vấn viên của chúng tôi sẽ trực tiếp gửi thông tin và chuyển đến quý khách trong thời gian sớm nhất. Chân thành cảm ơn !